Experts from the healthcare industry will unanimously tell you that health insurance is the best care for the India’s healthcare problems and the recent surge in premium for health insurance policies certainly conforms to that view. In spite of being a loss making proposition for most insurers, for an industry that is only a couple of decades old in India there is certainly a lot of optimism about its future prospects.

In 1986 when 'Mediclaim' was first launched by the Indian government it offered minimum and maximum health coverage of INR 15,000 and INR 5 Lakhs respectively. Today the minimum sum assured by the public sector insurance companies is INR 50,000 and INR 1 Lakh for the private sector companies while 95% of the online health insurance policies the minimum sum assured is INRs 3 Lakhs.

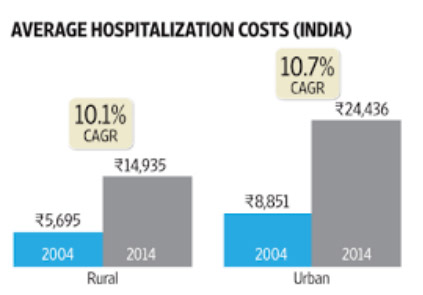

The cost of healthcare in India has grown at an exponential rate in the last decades or so, and any medical procedure that costs around INR 10,000 during the 80s and 90s now cost more than INR 50,000. Moreover, many treatment procedures like Angioplasty, MRI scan or CT scan were not even know during that time. Introduction of new and advanced technology has made the cost of medical procedures to soar, and with the arrival of the corporate hospitals they have actually increased multifold.

According to a report, medical inflation in India is currently pegged at just over 18% and consumers those once bought policies with of INR 1 Lakh sum assured are now willingly ready to pay premiums of INR 1 Lakh for policies that offer Rs 1 crore as sum assured.

In India health insurance started only as a cover for individual citizens and their families and then it offered reimbursement for hospital treatment only. There were also sub-limits and caps on every single item covered by the policies. But, as health care started to evolve the sub-limits were removed during the 1990s and with increasing number of private hospitals and improved life expectancy more and more people started to buy health insurance policies.